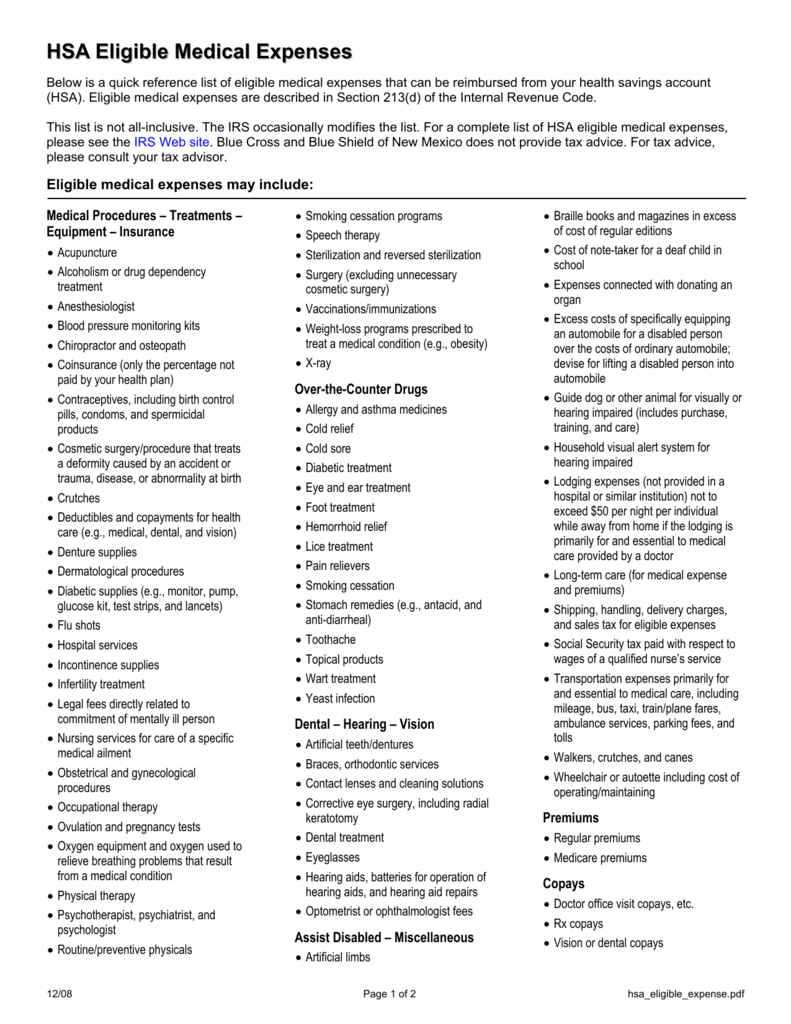

In other words, eligible medical expenses for HSAs are those, which normally would otherwise have qualified as a medical expense under Medical Expense Tax Credit. In general, any medically‐related expense that could be used to meet requirements for deductibility on a plan member's personal income tax return (in accordance with the Income Tax Act) is eligible for reimbursement. Under a Health Spending Account, plan members can be reimbursed for medically‐related expenses not covered by provincial health care plans. The following information is provided as a guideline only and does not supersede information or decisions rendered by Canada Revenue Agency. Balances remaining from health and dental plan claims automatically flow into the HSA plan-meaning no additional claim forms. With Alberta Blue Cross ®’s enhanced claiming processes, it’s easier than ever for employees to submit claims. And because the employee portion of health/dental plan rates are eligible expenses with Health Spending Accounts, the tax advantages of a Health Spending Account are better than ever. Tax advantagesĪ Health Spending Account from Alberta Blue Cross ® provides an avenue for you to deliver tax‐effective compensation to your employees, using pre‐tax dollars just as if expenses were covered through the health/dental plan. Active role in healthĪn Alberta Blue Cross ® Health Spending Account allows employees to take a more active role in their health-using their HSA "credits" wisely and becoming more accountable for their own benefit plan. Offering an HSA to your employees not only helps maintain a healthy, productive workforce, but gives you an edge for attracting and retaining high‐calibre employees. HSAs also help your employees pay co‐insurance payments, deductibles and amounts in excess of their health and dental plan limits. HSAs reimburse your employees for a wide range of health related expenses not covered by provincial medicare plans and for services no longer covered by government programs. Added flexibilityĪlberta Blue Cross ® Health Spending Accounts add flexibility to group benefit plans by addressing the varying needs of your workforce. Alberta Blue Cross ® Health Spending Accounts have become an important component of many groups' overall benefit programs.

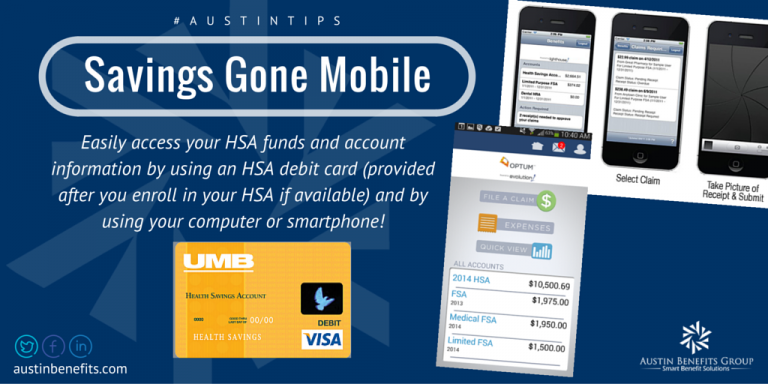

Alberta Blue Cross ® offers a variety of options for employers to fund HSA accounts. How does it work?Ĭredits (dollars) are allocated into a Health Spending Account that employees can use to pay for eligible medical and dental expenses not covered under your group or provincial medical plan. Whether you need to manage costs because of a slowdown or a tight labour market, offering an HSA as part of your Alberta Blue Cross ® benefit plan gives your business a valuable edge in attracting and retaining quality employees. HSAs provide the ultimate blend of flexibility and cost containment, while enabling your employees to pay for medical and dental expenses not otherwise covered by your plan-with non‐taxable dollars. Register or sign in to member site or appĪ Health Spending Account (HSA) from Alberta Blue Cross ® is an innovative way to complement your group benefit plan.Learn more about programs like the Métis Health Benefits Program or Specified Disease Condition Program.Government of the Northwest Territories.

0 kommentar(er)

0 kommentar(er)